ARTIFICIAL INTELLIGENCE (AI)

ASSISTED TRADING DECISIONS

Supercharge your day trading decisions with Artificial Intelligence (AI) backed decision making

Day trading is a fast-paced and high-stakes endeavor, requiring traders to make split-second decisions that can have a significant impact on your profitability. To succeed in this competitive arena, traders need all the tools and insights they can get. The QuantCycles Indicator is a powerful custom-built – Artificial Intelligence (AI) & Machine Learning (ML) driven add-on for NinjaTrader. Our system is designed to offer day traders a predictive advantage using advanced Fourier Cycle Analysis, Hurst Cycles and W.D. Gann theories. These theories and methods help make more informed trading decisions using Artificial Intelligence (AI) backed predictions.

Machine Learning (ML) helps refine our decision making system

Machine Learning (ML) is instrumental in maintaining the focus and currency of our QuantCycles tools. Through ongoing analysis of extensive datasets and market dynamics, our Machine Learning (ML) algorithms spot emerging patterns and trends, enabling us to dynamically refine and adjust our tools in real-time.

Artificial Intelligence (AI) backed analysis

By harnessing the capabilities of Artificial Intelligence (AI), we create End of Day Analysis reports for predictive analytics, providing our customers with precise and timely insights to stay informed about the latest developments and optimize their returns effectively.

Introducing V4.0 of the QuantCycles Indicator: The Game-Changer

The fourth generation of the QuantCycles Indicator is a cutting-edge tool that leverages Artificial Intelligence (AI) to provide day traders with predictive alerts, giving you a significant edge in the dynamic world of day trading. Here’s how this program can help traders make more money:

Predictive Insights: The heart of the QuantCycles Indicator lies in its ability to use Artificial Intelligence (AI) to help predict market trends, turning historical data and Machine Learning (ML) driven analysis into actionable insights. By forecasting potential price movements, traders can identify optimal entry and exit points, enhancing your chances of making profitable trades.

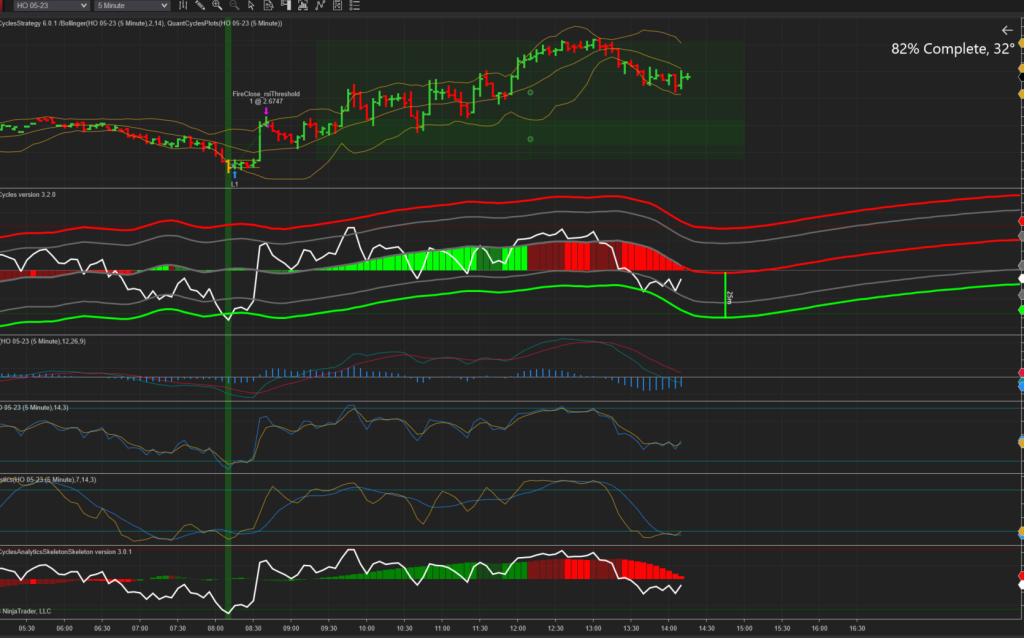

Plot Alert Points: The ability to plot alert points directly on all market sector charts inside NinjaTrader, provides you with a visual representation of critical decision points, facilitating swift and informed decision-making. With our advanced Fourier Cycle Analysis, Hurst Cycles and W.D. Gann theories enhanced system, enhanced with you can easily chart Hurst Cycles to help your daily trading.

Risk Management: Successful day trading is not just about making winning trades but also about managing risks effectively. QuantCycles assists traders by assessing risk levels and suggesting stop-loss and take-profit levels based on Artificial Intelligence (AI) and Machine Learning (ML) generated and analysis. This helps you protect your capital and minimize losses, ultimately leading to more consistent profitability.

Timing Precision: Timing is everything in day trading, and the QuantCycles Indicator excels at pinpointing the most opportune moments to enter or exit a trade. It considers multiple factors, such as price patterns, historical data, and market sentiment, to provide traders with precise timing recommendations.

Real-Time Alerts: The QuantCycles Indicator offers real-time alerts, ensuring traders never miss a potentially profitable opportunity. Whether it’s a trend reversal, a breakout, or a critical support/resistance level breach, traders receive instant notifications, allowing you to take quick action.

Reduced Emotional Bias: Emotions can cloud judgment and lead to impulsive decisions, often resulting in losses. The QuantCycles Indicator eliminates emotional bias by relying on historical data-driven analysis. Traders can make decisions based on facts and strategies rather than succumbing to fear or greed.

Adaptability and Customization: The program is adaptable to various trading styles and markets, catering to the diverse needs of day traders. Users can customize parameters and settings to align with your specific trading goals and preferences.

End of Day Analysis: At the close of each trading day, the QuantCycles Artificial Intelligence (AI) System diligently analyzes market data, the day’s price action, trend developments and provides you with a close of market comprehensive analysis report.

The QuantCycles Indicator will help you make better decisions

The QuantCycles Indicator is a game-changer for day traders seeking to boost your profitability and achieve consistent success. By harnessing our knowledge of advanced Fourier Cycle Analysis, Hurst Cycles and W.D. Gann theories of Artificial Intelligence (AI), our custom-designed application offers predictive insights, precise timing recommendations, risk management tools, and real-time alerts. It empowers traders to make informed decisions, reduce emotional bias, and optimize your strategies.

QuantCycles Theories in practice

W.D. Gann, a renowned financial trader of the early 20th century, crafted advanced theories and methodologies for market analysis and forecasting. His insights were deeply rooted in mathematical concepts like Fourier analysis, which identifies cyclical patterns in trading data. While Gann’s era predated the work of J.M. Hurst, who pioneered Hurst Cycles for predictive analysis in the mid-20th century, Gann’s contributions stand independently. Our Machine Learning (ML) and Artificial Intelligence (AI) algorithms build upon the foundational work of Gann, Fourier, and Hurst.

Artificial Intelligence (AI) driven Machine Learning (ML)

QuantCycles harnesses the power of Artificial Intelligence (AI) to provide users with highly accurate market analysis. Through advanced Artificial Intelligence (AI) algorithms, the platform processes vast amounts of historical and real-time market data, identifying intricate patterns and trends that might be difficult for human analysts to discern. This data-driven, Machine Learning (ML) refined approach enables QuantCycles to generate precise insights into market behavior, pinpoint optimal entry and exit points, and offer users a deeper understanding of market dynamics. By continuously adapting to changing market conditions and utilizing Artificial Intelligence (AI) -driven analysis, QuantCycles empowers traders and investors to make more informed and confident decisions, ultimately enhancing their trading success.